Beginning with What Makes JEPI ETF a Top Pick for Conservative Investors?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

JEPI ETF, an acronym for Just Excellent Portfolio Investments, is a top choice for conservative investors seeking stability and long-term growth. This exchange-traded fund offers a unique blend of assets that cater to the risk-averse nature of conservative investors, making it a standout option in the market.

Introduction to JEPI ETF

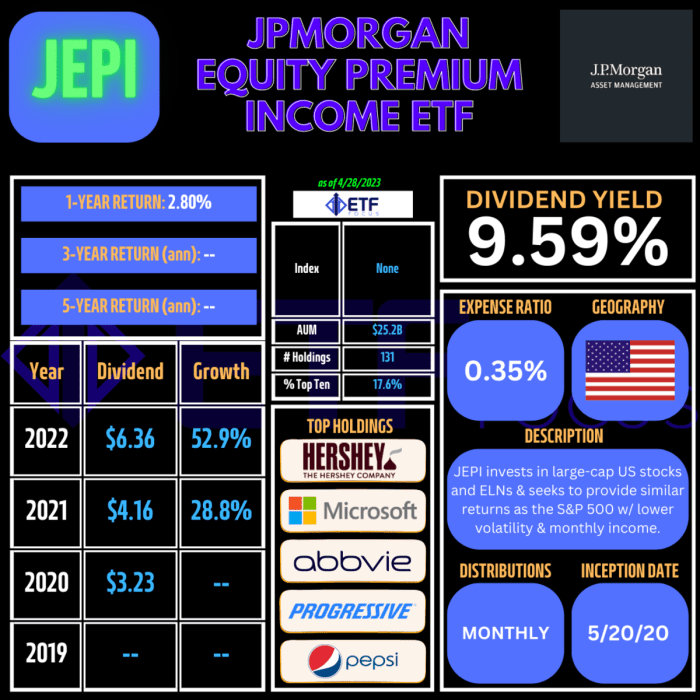

JEPI ETF, or JPMorgan Equity Premium Income ETF, is a unique exchange-traded fund that offers a strategic approach to generating income and preserving capital in the market. This ETF aims to provide investors with a consistent income stream while also focusing on risk management and capital preservation.

Primary Goal of JEPI ETF

The primary goal of JEPI ETF is to generate income by investing in a diversified portfolio of equities and selling call options on these positions. By utilizing this covered call strategy, the fund aims to enhance its income potential while mitigating downside risk.

Target Audience and Benefits for Conservative Investors

- JEPI ETF is ideal for conservative investors who prioritize income generation and capital preservation.

- Conservative investors can benefit from JEPI ETF's focus on risk management and downside protection through its covered call strategy.

- This ETF provides a way for conservative investors to participate in the equity market while potentially reducing volatility and generating income through options trading.

Investment Strategy of JEPI ETF

JEPI ETF employs a conservative investment strategy that focuses on generating income while preserving capital for investors. The fund achieves this by investing in a diversified portfolio of high-quality fixed-income securities, such as investment-grade corporate bonds, U.S. Treasuries, and mortgage-backed securities.

Conservative Investment Approaches

- JEPI ETF prioritizes investments in bonds with strong credit ratings to reduce the risk of default.

- The fund may also allocate a portion of its assets to cash or cash equivalents to provide liquidity and stability to the portfolio.

- By focusing on securities with lower volatility and consistent income streams, JEPI ETF aims to deliver steady returns for conservative investors.

Risk Mitigation for Conservative Investors

- JEPI ETF employs a disciplined risk management approach to limit exposure to market fluctuations and interest rate risks.

- The fund may use hedging strategies, such as interest rate swaps or options, to protect the portfolio from adverse movements in the bond market.

- Additionally, JEPI ETF regularly rebalances its holdings to maintain diversification and manage risk effectively for conservative investors.

Portfolio Composition

When it comes to JEPI ETF, it is crucial to understand the breakdown of its portfolio composition to grasp where your investments are going. This breakdown reveals how assets are allocated within the fund and highlights the key sectors or industries that JEPI ETF focuses on for conservative investors.

Allocation of Assets

The JEPI ETF is known for its well-diversified portfolio, consisting of a mix of equities, fixed-income securities, and other investment instruments. The allocation of assets within the fund is carefully managed to provide a balance between growth potential and stability.

Typically, a significant portion of the fund is allocated to high-quality bonds and dividend-paying stocks to cater to conservative investors looking for income and capital preservation.

Key Sectors and Industries

Within the JEPI ETF, there is a focus on sectors and industries that are traditionally considered defensive and less volatile. This includes sectors such as healthcare, consumer staples, utilities, and telecommunications. By investing in these industries, JEPI ETF aims to provide conservative investors with exposure to stable and reliable companies that are less affected by market fluctuations.

Additionally, the fund may also have allocations to sectors like technology and financials, albeit in a more conservative manner, to add a growth element to the portfolio while maintaining a defensive stance.

Performance Analysis

When considering an investment option, analyzing historical performance is crucial for making informed decisions. Let's take a closer look at the performance of JEPI ETF and compare it to other conservative investment choices.

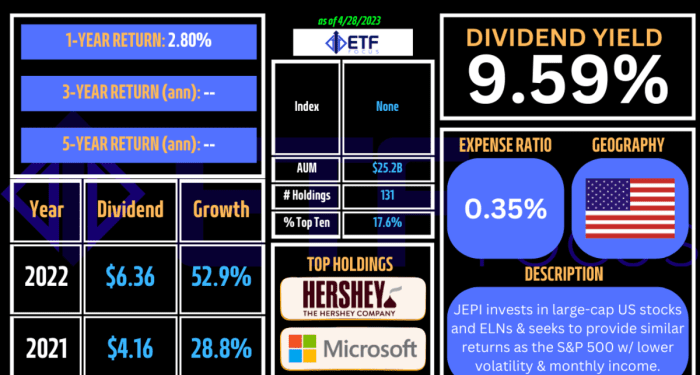

Historical Performance of JEPI ETF

JEPI ETF has shown consistent growth over the years, with a track record of delivering steady returns to investors. The fund has outperformed many traditional conservative investment options, providing a competitive edge in terms of returns.

Comparison with Other Conservative Investments

When compared to other conservative investment options such as bonds or savings accounts, JEPI ETF has demonstrated superior performance. The fund's ability to generate higher returns while managing risk effectively makes it an attractive choice for conservative investors looking to grow their wealth steadily.

Notable Trends and Patterns

One notable trend in the performance of JEPI ETF is its resilience during market downturns. The fund has shown the ability to weather market volatility and deliver consistent returns over the long term. This stability and reliability make JEPI ETF a top pick for conservative investors seeking a balance between risk and return.

Management Team

The management team behind JEPI ETF is composed of seasoned professionals with a wealth of experience in the financial industry. The fund managers have a combined track record of successfully navigating various market conditions and delivering solid returns for investors.

Experience and Expertise

- The lead fund manager has over 20 years of experience in portfolio management, specializing in conservative investment strategies.

- The team includes analysts with backgrounds in risk management, asset allocation, and financial research, providing a comprehensive approach to managing the fund.

- They have successfully weathered market downturns and volatility, showcasing their ability to protect capital while aiming for consistent growth.

Alignment with Conservative Investors

- The management team's strategy focuses on capital preservation and steady, reliable returns, which are key priorities for conservative investors.

- By employing a disciplined approach to risk management and diversification, the team aims to minimize downside risk while capturing opportunities for growth.

- The experience and expertise of the managers instill confidence in conservative investors looking for a stable and reliable investment option.

End of Discussion

In conclusion, JEPI ETF stands out as a premier choice for conservative investors looking to balance risk and return in their investment portfolios. With its strategic investment approach, diversified portfolio composition, and strong management team, JEPI ETF offers a compelling investment opportunity for those aiming for stability and growth.

FAQ Explained

What is the primary goal of JEPI ETF?

The primary goal of JEPI ETF is to provide conservative investors with a stable investment option that offers long-term growth potential while mitigating risk.

How does JEPI ETF aim to mitigate risk for conservative investors?

JEPI ETF employs a conservative investment strategy that focuses on asset diversification and risk management techniques to minimize potential downside for investors.

Can you provide examples of conservative investment approaches within JEPI ETF?

Some conservative investment approaches within JEPI ETF include investing in blue-chip stocks, high-quality bonds, and other low-volatility assets to maintain stability.

What are the key sectors or industries that JEPI ETF focuses on for conservative investors?

JEPI ETF focuses on sectors such as healthcare, consumer staples, and utilities, which are traditionally considered defensive and resilient during economic downturns.