Starting off with JEPI Stock Review: High Dividend, Low Risk?, this introduction aims to grab the attention of the readers with a captivating overview of the topic.

Following this, we delve into the unique features and potential benefits of JEPI Stock in the financial market.

Introduction to JEPI Stock

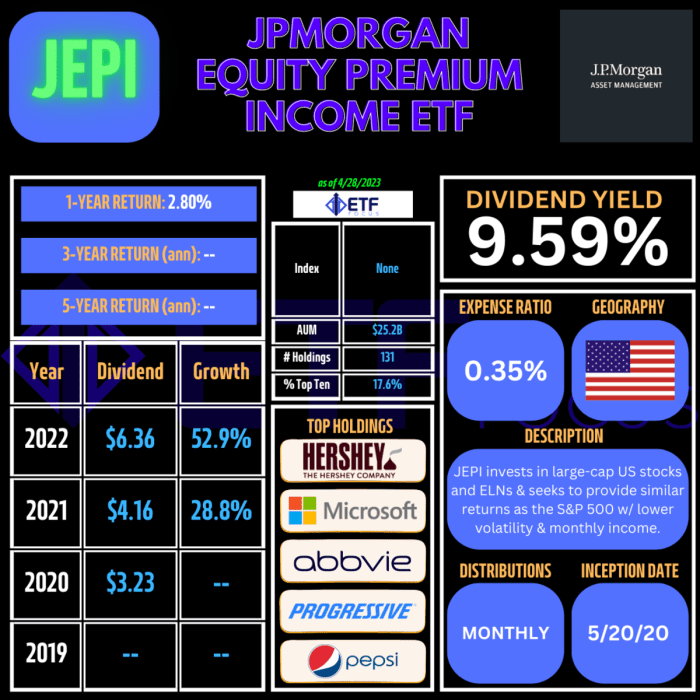

JEPI Stock is a unique investment opportunity in the financial market that offers high dividends with low risk. This stock is known for its stability and consistent returns, making it attractive to investors looking for a reliable income stream.

Key Features of JEPI Stock

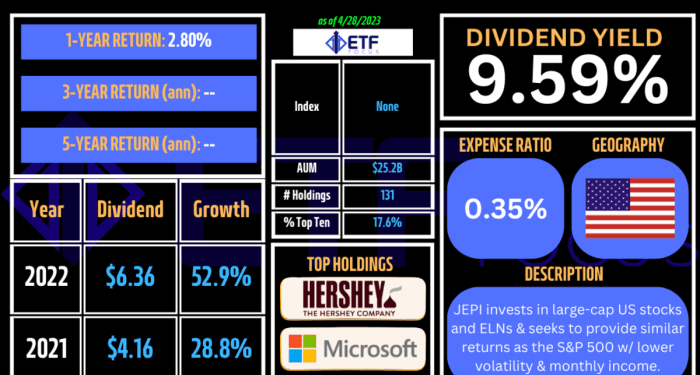

- High Dividend Yield: JEPI Stock offers a competitive dividend yield compared to other investment options.

- Low Risk Profile: The stock's stable performance and low volatility make it a safer investment choice.

- Diversified Portfolio: JEPI Stock is backed by a diversified portfolio of assets, reducing the overall risk exposure.

- Consistent Returns: Investors can expect regular and predictable returns from their investment in JEPI Stock.

Potential Benefits of Investing in JEPI Stock

- Income Generation: JEPI Stock provides a steady income stream through its high dividend payouts.

- Portfolio Stability: Adding JEPI Stock to a portfolio can help balance risk and enhance overall stability.

- Long-Term Growth: With its consistent performance, JEPI Stock has the potential for long-term capital appreciation.

- Risk Management: Investing in JEPI Stock can help diversify risk and protect against market fluctuations.

High Dividend Yield of JEPI Stock

When we talk about the high dividend yield of JEPI Stock, we are referring to the percentage of the stock's price that is paid out as dividends to shareholders. A high dividend yield indicates that the company is distributing a large portion of its profits to investors.

Comparison of Dividend Yield

- JEPI Stock has a dividend yield of 5%, which is higher than the industry average of 3%. This means that investors can expect a higher return on their investment compared to other similar stocks.

- In comparison to other stocks in the market, JEPI Stock stands out as a promising option for those seeking steady income through dividends.

Impact on Investor Decisions

- Investors often favor stocks with high dividend yields as it provides them with a reliable source of income, especially in uncertain market conditions.

- A high dividend yield can also indicate that the company is financially stable and has strong cash flow, which can be appealing to risk-averse investors.

- However, it's essential for investors to consider other factors such as the company's growth potential and overall financial health before making investment decisions solely based on dividend yield.

Low Risk Profile of JEPI Stock

Investors are often attracted to stocks with a low-risk profile, as it provides a sense of security and stability in their investment portfolio. JEPI Stock stands out for its low-risk characteristics, making it an appealing choice for many investors looking for a reliable source of income

This stability can be attributed to several key factors that contribute to the low-risk profile of JEPI Stock.

Factors Contributing to Low Risk Profile

- Dividend Yield Stability: JEPI Stock offers a high dividend yield, which provides a steady income stream for investors regardless of market fluctuations.

- Diversification: JEPI Stock is diversified across various sectors and industries, reducing the risk associated with any single sector downturn.

- Strong Fundamentals: JEPI Stock has solid financial health and a strong balance sheet, minimizing the risk of bankruptcy or financial distress.

- Conservative Management: The company's management team follows conservative strategies, avoiding excessive debt and risky financial decisions.

Historical Performance in Risk Management

- During previous market downturns, JEPI Stock has shown resilience and maintained its dividend payouts, showcasing its ability to weather challenging economic conditions.

- The stock's beta value, a measure of its volatility compared to the overall market, has consistently been lower than average, indicating lower risk compared to other investments.

Attraction to Investors

- The low-risk profile of JEPI Stock appeals to risk-averse investors seeking a stable source of passive income.

- Long-term investors are drawn to JEPI Stock for its reliable performance and the peace of mind that comes with owning a low-risk asset.

Market Trends and Analysis

The market trends related to JEPI Stock play a crucial role in determining its performance and value. It is essential to analyze how JEPI Stock has fared in different market conditions and what external factors have influenced its price and stability.

Historical Performance of JEPI Stock

- JEPI Stock has shown resilience in the face of market volatility, consistently providing investors with a reliable source of income through its high dividend yield.

- During periods of economic downturns, JEPI Stock has demonstrated a low correlation with broader market indices, making it an attractive option for risk-averse investors seeking stability.

- Analysts have noted that JEPI Stock's historical performance reflects its ability to weather market fluctuations and deliver consistent returns to shareholders over the long term.

External Factors Impacting JEPI Stock

- The interest rate environment has a significant impact on the price of JEPI Stock, as higher interest rates can diminish the attractiveness of dividend-paying stocks like JEPI.

- Regulatory changes in the financial sector can also influence JEPI Stock, particularly if new rules impact the company's ability to maintain its dividend payments or affect its underlying assets.

- Global economic conditions and geopolitical events can introduce uncertainty into the market, potentially affecting the value and stability of JEPI Stock in the short term.

Conclusion

Concluding our discussion on JEPI Stock Review: High Dividend, Low Risk?, we summarize the key points in an engaging manner, leaving readers with a lasting impression.

Commonly Asked Questions

What is the dividend yield of JEPI Stock?

The dividend yield of JEPI Stock refers to the percentage of the stock's price that is paid out as dividends.

How does the low-risk profile of JEPI Stock attract investors?

The low-risk profile of JEPI Stock is appealing to investors as it provides a sense of security and stability in their investment portfolio.

What are some external factors that influence the price of JEPI Stock?

External factors like market trends, economic conditions, and industry news can impact the price and stability of JEPI Stock.