Starting off with GM Stock vs. Tesla: Which One Is the Better Buy?, this opening paragraph aims to capture the readers' attention with a casual yet informative tone.

The following paragraph will delve into the specifics of the topic, providing a clear overview.

Overview of GM and Tesla

General Motors (GM) and Tesla are two prominent players in the automotive industry, each with a unique history and approach to the market.GM, founded in 1908, has a long-standing presence in the automotive industry and is one of the largest automobile manufacturers in the world.

With a focus on traditional gasoline-powered vehicles, GM has a wide range of brands under its umbrella, including Chevrolet, Buick, Cadillac, and GMC.On the other hand, Tesla, founded in 2003, is a relatively newer entrant into the market, specializing in electric vehicles (EVs) and clean energy.

Tesla has gained significant attention and market share for its innovative technology, sleek designs, and commitment to sustainability.

Key Differences in Business Models and Target Markets

- Business Models:

- GM primarily focuses on traditional internal combustion engine vehicles, while Tesla is at the forefront of EV technology.

- GM has a wide range of vehicle brands catering to different market segments, while Tesla has a more streamlined product lineup.

- Tesla operates its own network of direct-to-consumer stores, while GM relies on a traditional dealership model.

- Target Markets:

- GM targets a broad range of consumers with its various brands and vehicle types, appealing to different needs and preferences.

- Tesla's target market consists of environmentally-conscious consumers, tech enthusiasts, and early adopters of EV technology.

- Tesla has a global presence, while GM has a more established presence in North America.

Financial Performance

Investors often rely on the financial performance of a company to make informed decisions about buying or selling stocks. In this section, we will compare the financial performance of General Motors (GM) and Tesla over the past five years, analyzing key metrics such as revenue, profit margins, and market capitalization.

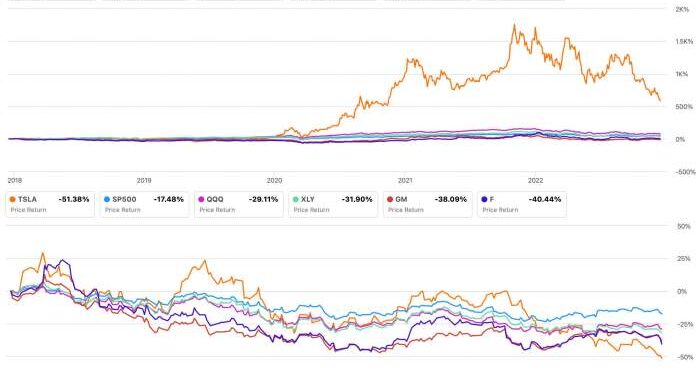

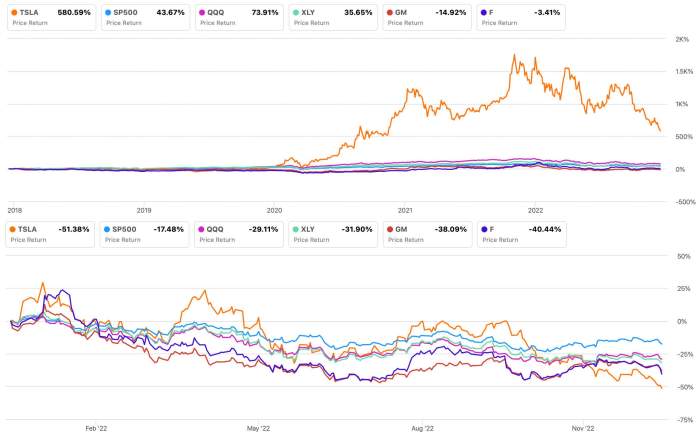

Stock Performance

- Over the past five years, General Motors (GM) has shown a relatively stable stock performance, with gradual growth and occasional fluctuations. On the other hand, Tesla has experienced significant volatility in its stock price, with sharp increases and declines.

- GM's stock has been impacted by factors such as changes in consumer demand, global economic conditions, and regulatory issues. Tesla's stock, on the other hand, has been influenced by production challenges, CEO statements, and market sentiment towards electric vehicles.

Financial Metrics

- GM has consistently reported higher revenue compared to Tesla, given its established presence in the automotive industry and diversified product portfolio. However, Tesla has shown rapid revenue growth driven by increasing demand for electric vehicles.

- When it comes to profit margins, GM has generally maintained stable margins, benefiting from cost-cutting measures and operational efficiencies. In contrast, Tesla's profit margins have been more volatile, impacted by production costs, pricing strategies, and investments in new technologies.

- Market capitalization reflects the total value of a company's outstanding shares. GM's market cap is typically lower than Tesla's due to the difference in stock prices and the number of shares outstanding.

Recent Developments

- Both GM and Tesla have made significant investments in electric vehicle technology and autonomous driving systems, aiming to capture future market opportunities and stay ahead of competitors.

- GM's recent focus on electric vehicles and commitment to achieve carbon neutrality by 2040 have resonated well with investors, driving stock performance and enhancing its market position.

- Tesla's inclusion in the S&P 500 index and successful expansion into new markets such as China have boosted investor confidence and contributed to its strong financial performance.

Product Lineup and Innovation

When comparing GM and Tesla, it's important to look at their product lineups and the level of innovation each company brings to the table.Tesla, known for its electric vehicles, offers a range of models including the Model S, Model 3, Model X, and Model Y.

These vehicles are known for their cutting-edge technology, long-range capabilities, and sleek design. Tesla vehicles also come with features like Autopilot, over-the-air software updates, and a large touchscreen interface.On the other hand, GM offers a mix of traditional gas-powered vehicles along with some electric options like the Chevrolet Bolt EV

GM's lineup includes popular models like the Chevrolet Silverado, GMC Sierra, and Cadillac Escalade. While GM may not be as focused on electric vehicles as Tesla, they are working on expanding their electric lineup with the upcoming GMC Hummer EV and Cadillac Lyriq.

Technological Innovations

- Tesla vehicles are equipped with advanced autonomous driving features like Autopilot and Full Self-Driving capabilities, setting them apart in the market.

- GM has been investing in electric vehicle technology and plans to introduce the Ultium battery platform, which aims to deliver longer range and faster charging times for their electric vehicles.

- Tesla's over-the-air software updates allow for continuous improvements and added features without the need to visit a dealership, enhancing the overall user experience.

Upcoming Products and Technologies

- Tesla is set to release the Cybertruck, Semi truck, and Roadster in the near future, showcasing their commitment to pushing the boundaries of electric vehicle technology.

- GM's upcoming electric vehicles like the GMC Hummer EV and Cadillac Lyriq are expected to compete with Tesla's offerings and attract customers looking for high-performance electric vehicles with luxury features.

Sustainability and ESG Initiatives

Both GM and Tesla have made significant strides in incorporating sustainability and ESG (Environmental, Social, and Governance) initiatives into their business models.

Environmental Initiatives

- GM has committed to transitioning to an all-electric future, with plans to offer 30 electric vehicles globally by 2025. They are also working towards achieving carbon neutrality in their global products and operations by 2040.

- Tesla, on the other hand, has been a pioneer in electric vehicle technology and sustainable energy solutions. Their Gigafactories are powered by renewable energy sources, and they have set ambitious goals to reduce their carbon footprint.

Social Responsibility Efforts

- GM has focused on diversity and inclusion initiatives, aiming to increase representation of women and underrepresented minorities in their workforce. They have also invested in community programs and initiatives to support education and economic development.

- Tesla has implemented fair labor practices and prioritized workplace safety. They have also been involved in philanthropic efforts, such as providing solar energy solutions to underserved communities.

Supply Chain Practices

- GM has been working to improve the sustainability of their supply chain by setting goals to source materials ethically and reduce waste. They are also collaborating with suppliers to reduce emissions and enhance transparency.

- Tesla has been actively engaging with suppliers to ensure responsible sourcing of materials and reduce the environmental impact of their supply chain. They have also implemented recycling programs to minimize waste.

Long-Term Impact on Growth and Investor Appeal

- Both GM and Tesla's sustainability initiatives can enhance their long-term growth prospects by attracting environmentally conscious consumers and investors. Companies with strong ESG practices are increasingly viewed favorably by the investment community.

- By reducing their carbon footprint, improving supply chain transparency, and investing in social responsibility, GM and Tesla are positioning themselves as leaders in sustainable business practices, which could contribute to their competitiveness and resilience in the market.

Outcome Summary

Concluding the discussion with a summary that wraps up the key points in an engaging manner.

Essential FAQs

Which company has a higher revenue currently?

As of now, Tesla has a higher revenue compared to GM due to its focus on electric vehicles and innovative technologies.

What sets GM apart from Tesla in terms of target market?

GM typically targets a broader market with traditional vehicles, while Tesla caters more towards the luxury electric vehicle segment.

How do GM and Tesla differ in their sustainability efforts?

GM focuses on reducing its carbon footprint through initiatives like recycling, while Tesla emphasizes sustainability through renewable energy solutions.